The equivalent for businesses is an Employer Identification Number (EIN). citizens using their social security numbers. You can apply for an EIN online or mail in Form SS-4.The application is free and you can access it online, by mail, or by phone. Your EIN is a unique number that identifies your business.

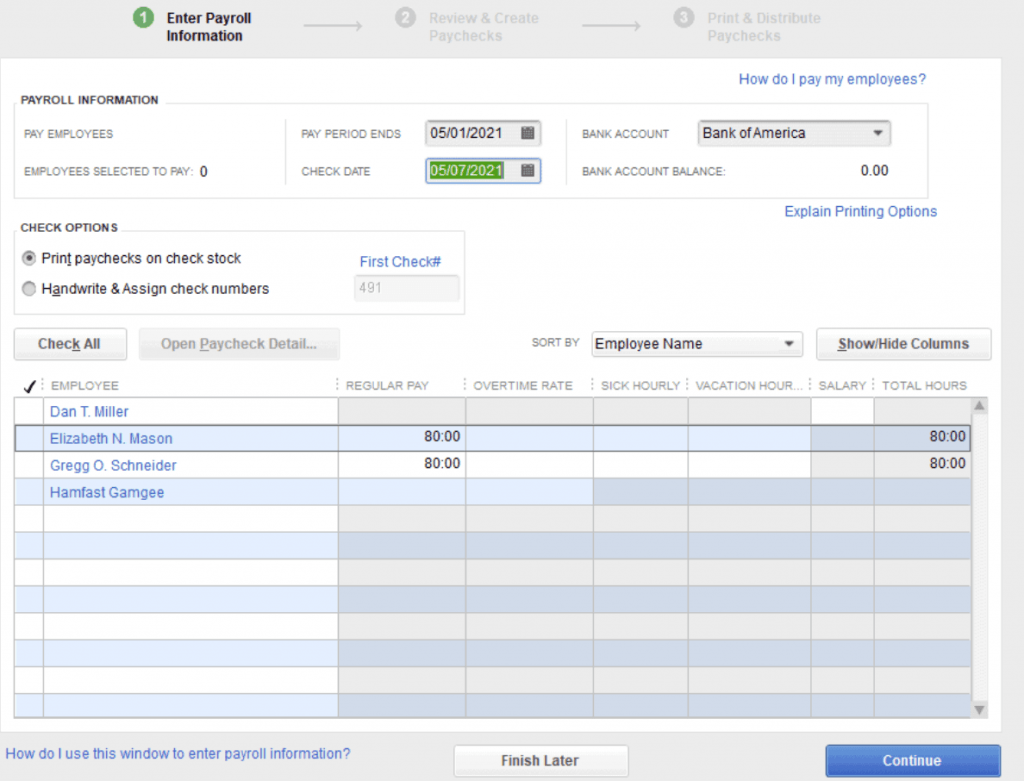

If you’re hoping to save money on payroll-related costs and ready to get those brain neurons firing, follow along with these 9 steps to learn how to do payroll by yourself.īefore running payroll for the first time, you’ll need to set up an Employer Identification Number (EIN) with the Internal Revenue Service (IRS).

This includes getting your federal identification number, or FEIN, then establishing a payroll deposit schedule, and finally, registering with both federal and state agencies to submit those payroll taxes electronically,” says Garcia. First, you need to establish tax and registration information for your business. “Doing payroll yourself manually involves several steps. Calculating tax withholding amounts, gross and net pay, and additional deductions is no easy task, but it has to get done.

0 kommentar(er)

0 kommentar(er)